How to Read a Candlestick Chart: A Beginner’s Guide

What Are Candlesticks and How Are They Formed?

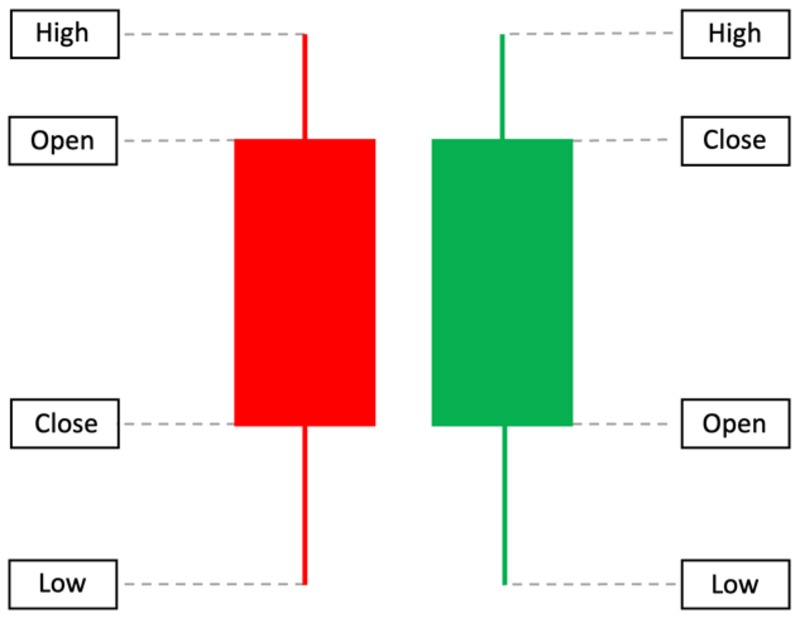

A candlestick represents price movement over a specific time period—this could be one minute, one hour, one day, or any other time frame you set on your chart.

Each candlestick tells a story of four price points:

-

Open – The price when the period began

-

Close – The price when the period ended

-

High – The highest price during the period

-

Low – The lowest price during the period

Candlesticks show not just what price did—but how the market felt during that time.

Anatomy of a Candlestick: Body and Wicks

A single candlestick is made up of:

-

The Body – This is the thick part of the candle. It shows the range between the opening and closing prices.

-

The Wick (or Shadow) – These are the thin lines above and below the body, representing the highest and lowest prices.

-

Color – Most charts use green (or white) for bullish candles (close > open) and red (or black) for bearish candles (close < open).

Quick Tip:

-

A long body = strong momentum.

-

A long wick = market tested levels but reversed.

-

A short body = indecision.

Basic Candlestick Patterns Every Beginner Should Know

Here are a few simple yet powerful candlestick formations that appear across all financial markets:

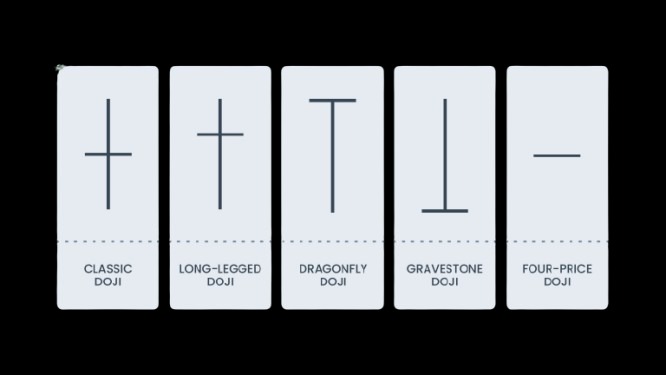

1. Doji

A Doji forms when the open and close are nearly equal. It indicates market indecision.

📌 What it means: Buyers and sellers are in a standoff—could signal a potential reversal.

Types of Doji Candles and Their Meanings

Each variation of a Doji gives different clues depending on the position of the wick(s) and where it appears relative to the trend.

1. Standard Doji (or Neutral Doji)

Visual: Small body with roughly equal upper and lower wicks

Meaning: Pure indecision. Neither bulls nor bears have momentum.

Where it appears: Often during consolidation or before major news.

2. Long-Legged Doji

Visual: Small or no body, with long upper and lower wicks

Meaning: Strong back-and-forth price action; market tested both directions.

Potential signal: Volatility and uncertainty, may precede a breakout.

Pro Tip: Watch for confirmation in the next candle.

3. Dragonfly Doji

Visual: Open, close, and high are nearly equal; long lower wick

Meaning: Price was pushed down significantly but buyers drove it back up.

Signal: Bullish reversal, especially after a downtrend

Best used with: Support levels or confirmation candles

4. Gravestone Doji

Visual: Open, close, and low are nearly equal; long upper wick

Meaning: Buyers drove price up, but sellers took over before close.

Signal: Bearish reversal, especially after an uptrend

Often seen at: Resistance zones or tops of bullish moves

5. Four Price Doji (Rare)

Visual: No wicks at all — open = close = high = low

Meaning: Absolute indecision, zero volatility

Usefulness: Not very actionable on its own, but interesting to note.

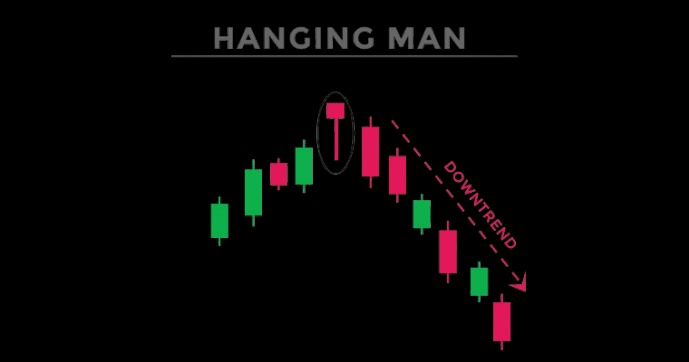

2. Hammer

The hammer has a small body and a long lower wick. It typically appears after a downtrend.

📌 What it means: Strong rejection of lower prices; can indicate a bullish reversal.

Hammer vs. Hanging Man

The Hammer and Hanging Man look almost identical—but their context is different:

|

Pattern |

Appears After |

Possible Signal |

|

Hammer |

Downtrend |

Bullish Reversal |

|

Hanging Man |

Uptrend |

Bearish Reversal |

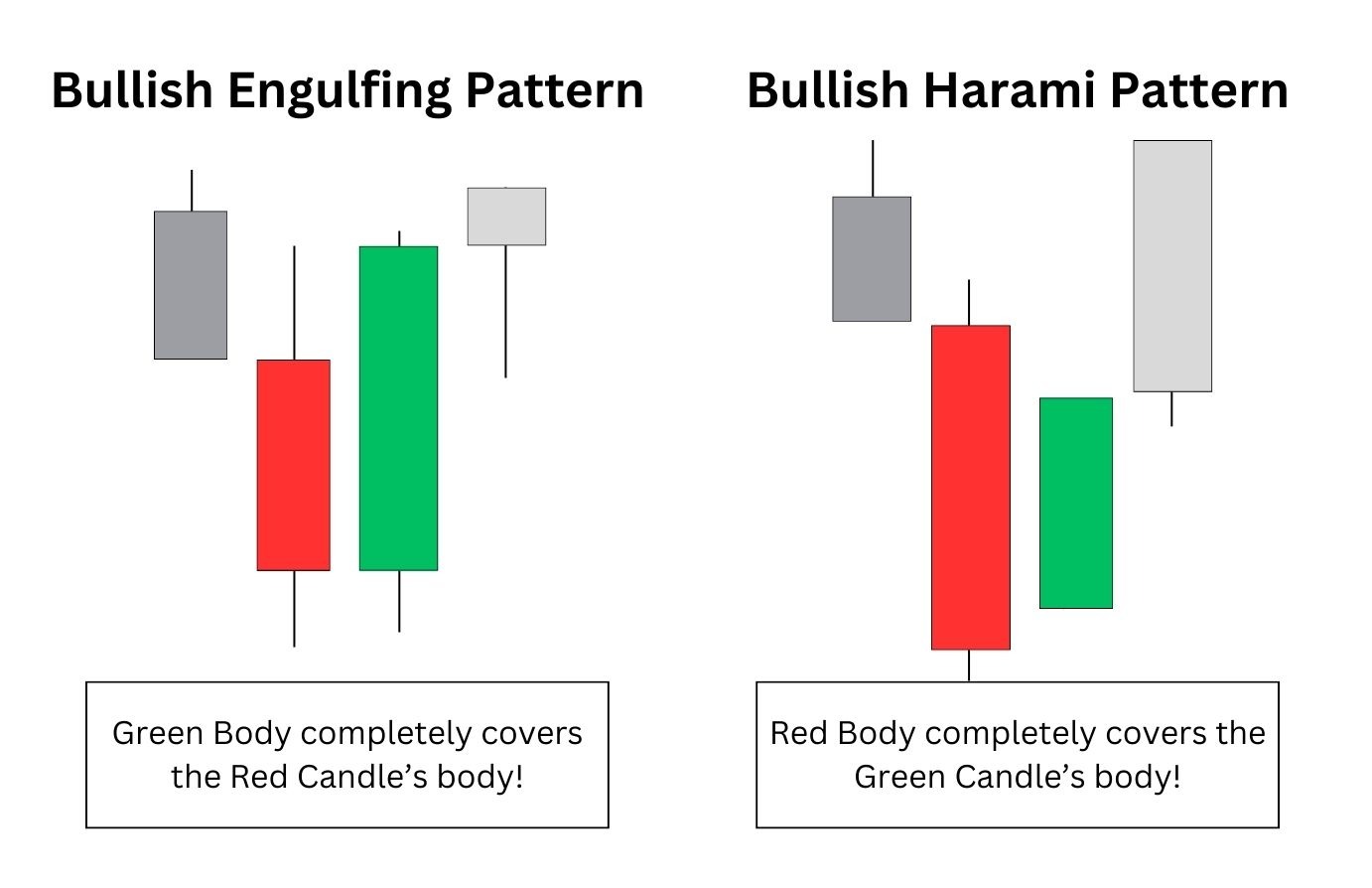

3. Engulfing

-

Bullish Engulfing: A small red candle followed by a large green candle that completely "engulfs" the previous one.

-

Bearish Engulfing: The opposite—bullish candle engulfed by a larger bearish candle.

📌 What it means: Momentum is shifting. This pattern often appears at turning points.

Bullish vs. Bearish Candlestick Signals

Understanding the directional signals in candlestick patterns can give you a strong edge.

|

Type |

Visual Clues |

What It May Signal |

|

Bullish |

Long lower wick, green body, hammer |

Reversal or trend continuation upward |

|

Bearish |

Long upper wick, red body, shooting star |

Weakness or downward pressure |

|

Neutral |

Small body, equal wicks (Doji) |

Indecision or consolidation |

Pro Tip:

Always read candlesticks in context. A single candle can mean little—patterns are stronger when they appear near support/resistance levels or within trends.

Why Candlestick Charts Matter

Candlestick charts simplify price data and highlight emotions behind market moves: fear, greed, hesitation, conviction.

Whether you’re trading forex, stocks, or crypto—candlestick reading is a universal skill that works across all markets.